Planning a big RTW (Round The World) trip?

Considering dabbling in long term travel?

Spending a couple months backpacking around Thailand?

Congratulations on making the decision to escape your comfort zone and travel the world.

Chances are you have heaps of things on your mind: What kind of backpack to choose? How to get the cheapest airfare? Will you survive long term travel?

One big decision you’ll also have before setting off on your backpacking or round-the-wold trip is whether or not to invest in travel insurance.

Many backpackers choose to not take out a travel insurance policy as they feel it is highly unlikely they will make a claim and therefore it’s a waste of money. While it may hurt initially to put down the money for an insurance policy, it’s foolish to backpack without travel insurance.

There are heaps of benefits to taking out a travel insurance policy, and here are four great reasons you should invest in travel insurance before setting off on your trip of a lifetime:

1) No-Fault Cancellations

Most travel insurance policies will cover you in the event that your transport has been canceled. The cost of flights are often the most expensive costs of your backpacking trip, and in the event you need to purchase alternative tickets this feature is essentially priceless.

Cancellations cover can also cover losses due to bad weather, illness and failures in service where the transportation provider is at fault.

2) Emergency Medication

For backpackers who require prescription medication to be taken frequently while abroad, travel insurance is a must. In the instance where your bag has been lost or stolen with your medication inside, a comprehensive travel insurance policy will cover the costs of having an emergency prescription filled in a foreign country.

In many cases this can be a huge expense, and if not covered by an insurance policy this could spell disaster – and possibly cut your backpacking trip short.

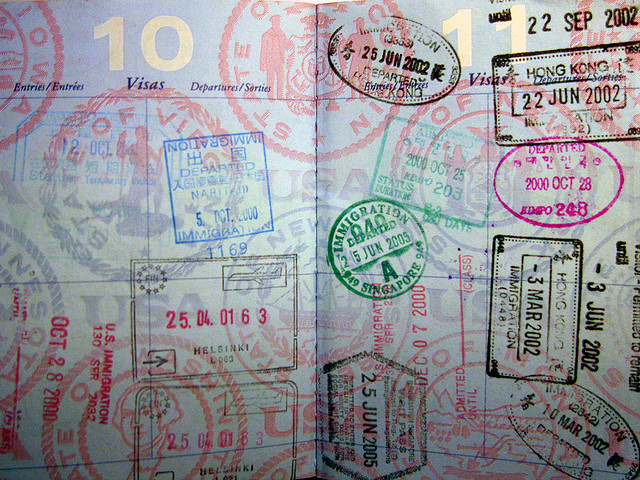

3) Cash and Passport Cover

Any backpacker’s nightmare is to have their cash and passport lost or stolen while overseas. Not only can it take weeks to get a replacement, the cost involved will very easily break your budget. Travel insurance can provide peace of mind while visiting another country.

If you find yourself without your passport or cash, insurance cover will provide emergency travel funds as well as a replacement passport, meaning you can continue your backpacking trip hassle-free.

4) Accident Liability Cover

![Creative Commons: [Satbir] Creative Commons: [Satbir]](https://www.backpackingmatt.com/wp-content/uploads/2010/12/Discover.jpg)

Along with a range of additional benefits and features of travel insurance, the four reasons mentioned are great reasons to purchase a travel insurance policy before departing on your long term backpacking trip.

What’s your take? Any tips on choosing a travel insurance policy? Leave any benefits to purchasing a travel insurance policy or your experiences in the comments section below.

Disclaimer: This post was sponsored by Allianz.

Backpacking Matt

Backpacking Matt

HAPPY BIRTHDAY, MATT!

Only fitting I’m off to Galway tomorrow to knock back (more than) a few pints tomorrow and remember being there with you and Brian a few years ago. And eat curry chips, clearly! Best wishes and a big beso from Spain!

Actually a great international health plan that will cover for 100% of any treatment or diagnostics needed and also includes emergency medical evacuation, emergency reunion, trip interruption and repatriation of remains is this: https://www.worldtrips.com/quotes/atlas/?referid=9800575

I buy it every time I leave my country and have never had to pay any $ out of pocket for any injuries! It’s amazing and very inexpensive!

@Jayme Thanks for the suggestion on an insurance plan.

I’ve been robbed, twice. That’s reason enough to get insurance.

@Ayngelina Hopefully you were insured?

Good post Matt, was wondering what I should do for my upcoming trip. If I’m traveling for 11 months, do you have a rough estimate of what I would pay?

Any advice on companies that are great to work with?

-Steve

@Steve Check out this post’s sponsor – also, World Nomads is good for budget travelers. Expect to pay anywhere from 300 – 500 for 12 months of coverage.

Some good points. I have never bought travel insurance, but I think the time has come!

We got insurance – better to be safe than sorry. We’ve had two medical trips but the excess meant that it wasn’t worth while to claim!

Still have it though, mainly for peace of mind!

I’m a world nomads guy myself. I like their customer service.

Travel insurance is easy, you NEED IT. People that say oh but its too expensive I didn’t budget for it.

You insure yourself at home with home/contents insurance, health insurance, car insurance etc. So what on earth makes you think you don’t need it when your abroad, alone and in a country you don’t speak the language of??

@Chris Exactly – it’s a must & something you really need to budget pre-trip.

Travel insurance should be one of the first thing to think about when planning a trip. It’s easy to find, there’s many options available and it’s not that expensive when you think about how it could save you later.

I’m not proud to say I didn’t get insurance when I started traveling solo in ’09. I could have fallen off the side of macchu picchu and broken a leg or worse and then I would have been really SOL, but thankfully I made it home in one lucky, healthy piece. Next time I won’t take my chances!

@Mandi Glad you made it back in one piece – equally glad you’re getting insurance the next time around!

Sorry, but being in insurance, part of this blog is nonsense. The part where you say “For example, if you are exploring Bali on a motorbike, crash into someone, and a third property has been damaged or injured, this feature of travel insurance will cover any legal expenditures resulting from the accident.”

I am sorry, but you’ll find that ALL travel policies exclude liability when in control of a vehicle, whether it be a car, motorcycle or even a JetSki. The liability insurance should be covered by the insurance for the vehicle itself. If the vehicle you’re in control of doesn’t have any insurance, you’ll be on your own.

I suggest the author corrects this blog.